There is an increase in competition in the insurance business, with customers expecting faster turnaround, lower prices, and more options. This has forced insurance companies to review their processes and work on improvements and efficiency. Often times this includes hiring new people to help with the workload, improve turnaround times and reduce existing backlogs. However, in recent times with rising wages and short supply of qualified and experienced insurance professionals, this can be a problem.

Staff Boom offers fully customizable solutions for managing general agents and insurance carriers, providing a full team of insurance experienced staff at your disposal, and fully dedicated to your company. Our Staff Boom team goes through extensive insurance training prior to being assigned to you. Once they are assigned to be dedicated employees for your company, they get a second training based on your specific needs. Our goal is that Staff Boom employees become an extension of your company, and adjust to your needs, just like a new employee would.

Processing Endorsements for Insureds is a core function of any insurance operation. Licensed staff may be required to discuss coverage options and price, but processing the requested changes in the policy management system is simply data entry. Staff Boom employees are highly skilled in processing your changes that are submitted via online request, email, snail mail and fax. Whether the client purchased a new car, wants to schedule personal property or they want to add an additional insured. These tasks are necessary to keep clients satisfied and properly insured. Your Staff Boom team will do the heavy lifting so your underwriters and customer service team can remain focused on providing exceptional guidance and customer service.

Verifying the condition of the property location is a critical component in determining risk acceptability and reducing loss ratios. This task enables our specially trained staff to break down the risk, in accordance with the company standards, to ensure that the company is only insuring qualifying properties. During this essential step in the underwriting process, Staff Boom reps are trained to review overall acceptability, issue notices and pending cancellations for required updates to the insured property.

Determining risk acceptability is essential to the success of your business to ensure loss ratios are in line with written premium targets. We are here to make sure you are writing good business that will stay on the books for some time. Underwriting is such a huge component for ensuring future success. In some cases, the insured is shopping around solely on price alone, but sometimes it can also be because they are getting cancelled/non-renewed from their current carrier. Our team is trained to identify red flags and problem policies from the start. Considering that there is such a short time frame to either accept or flat cancel a new policy, we will work hard to make sure each item is reviewed promptly and efficiently.

Are your employees spending too much time reviewing driver history for acceptability? Let Staff Boom help ease that process! Our staff is trained on how the different DMV point systems translate per state and what is needed to qualify for the Good Driver Discount. They can tell the difference between what is considered a minor violation versus a major violation. They can tell the difference between what is considered a one-point accident versus a two-point accident and the difference between at fault or not at fault. They know the different types of driver’s license classifications and they can read suspensions breaks in a driver’s license.

A well-thought out renewal process is critical to the customer experience and ultimately retention. As an insurance carrier you know renewals are the most profitable segment of your business. Staff Boom understands how important renewals are. We can help you get ahead of your renewals by updating client information based on their requests and inspection reviews.

With Staff Boom, you have the ability to review every renewal and determine if the account should be non-renewed, conditionally-renewed or renewed with the existing coverage and rates. Utilizing your Staff Boom employees to review renewals saves time, money and helps keep your clients on the books.

Accuracy is essential in any business but in the insurance industry it’s key in avoiding Errors & Omissions (E&O) claims. Policies need to be double checked. You cannot run the risk of a policy not matching the quote a client signed or a missing signature on a critical policy exclusion. Staff Boom employees are trained to check policies based on the checklist your firm provides. Mistakes happen, we’ll be your second set of eyes and make sure mistakes don’t slip through the cracks.

The policy audit we provide will give you peace of mind that everything is accurate. If a mistake was made, we’ll help your underwriters and customer service team get it corrected.

There is a great deal of effort in getting new business policies on the books, but once you do, it can be a challenge to keep clients insured with your company. Since snail mail and emails can easily be missed, our goal is to make live contact as soon as possible. We want to let the insured know that we are on top of things and there to ensure we keep the policy active. Not many companies have the time to make a courtesy call, but we can on your behalf. This will also help with policy checking. If the insured lets us know that they did not receive any notification via regular mail or email, we can cross check what we have on file to make sure they are notified with plenty of time in the future. Let us help you keep your existing accounts active.

Once you have received new business for an insured and verified acceptability by underwriting the risk, the last thing you want to do is have a policy cancel. Why go through all the hard work just to let it go? Whether it is reinstating with a lapse in coverage or no lapse, our trained insurance professionals understand the requirements needed to reinstate a policy. Whether it was pending for underwriting reasons or non-payment, we can follow up to make sure the policy is back to good standing and that all of the necessary documentation and attachments are included.

Payments are such a big part of the day to day tasks of an insurance company. It’s a simple task yet it is extremely time consuming. Our staff is trained on the different payment plans offered and what information needs to be collected to process these payments. Whether it is a credit/debit card or account/routing number, we always stress the importance of security when it comes to such private information. Confidentiality is of the upmost importance to us.

Yes, even in today’s day and age companies still receive snail mail. Although this is a tedious and time-consuming process, of having to review each and every single document and determine who it needs to be routed to, someone’s got to do it. Let Staff Boom help by taking this task on so they can focus on your core business.

You may be asking yourself, “How does this work?” Well, all you need to do is scan the mail into a folder and Staff Boom will take care of the rest. Our employees will review the work bucket folder every night (this is dependent of what time you would like the team to work). Once the mail is reviewed, they can forward the mail to the appropriate department/person.

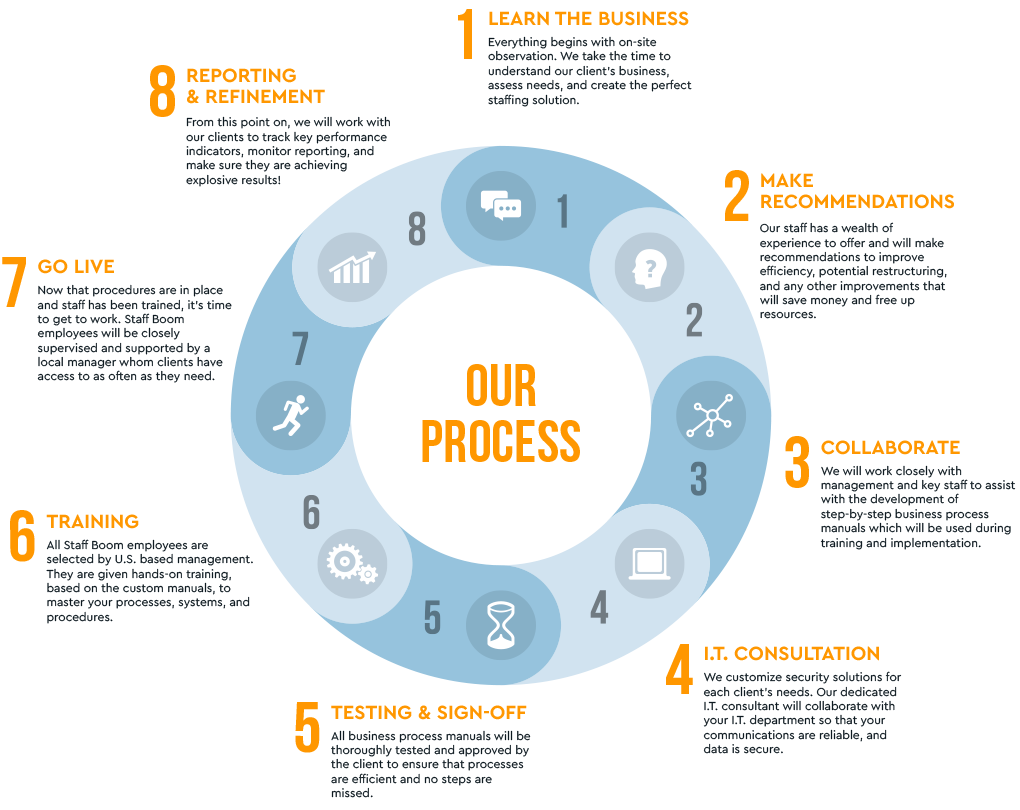

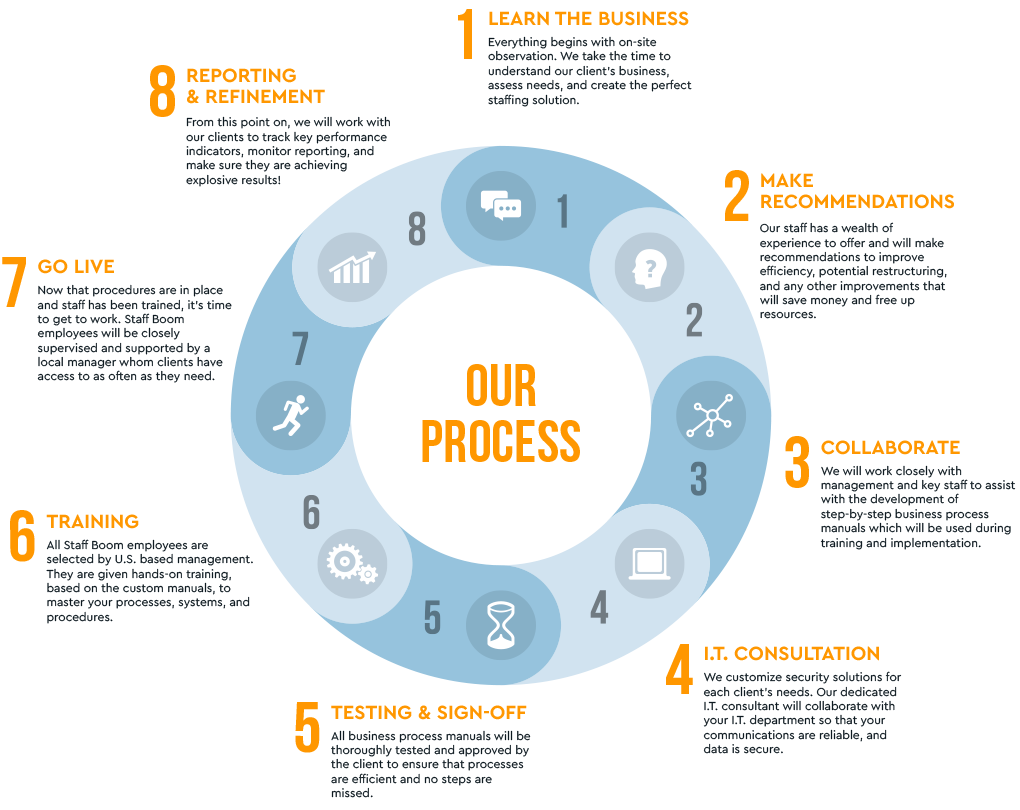

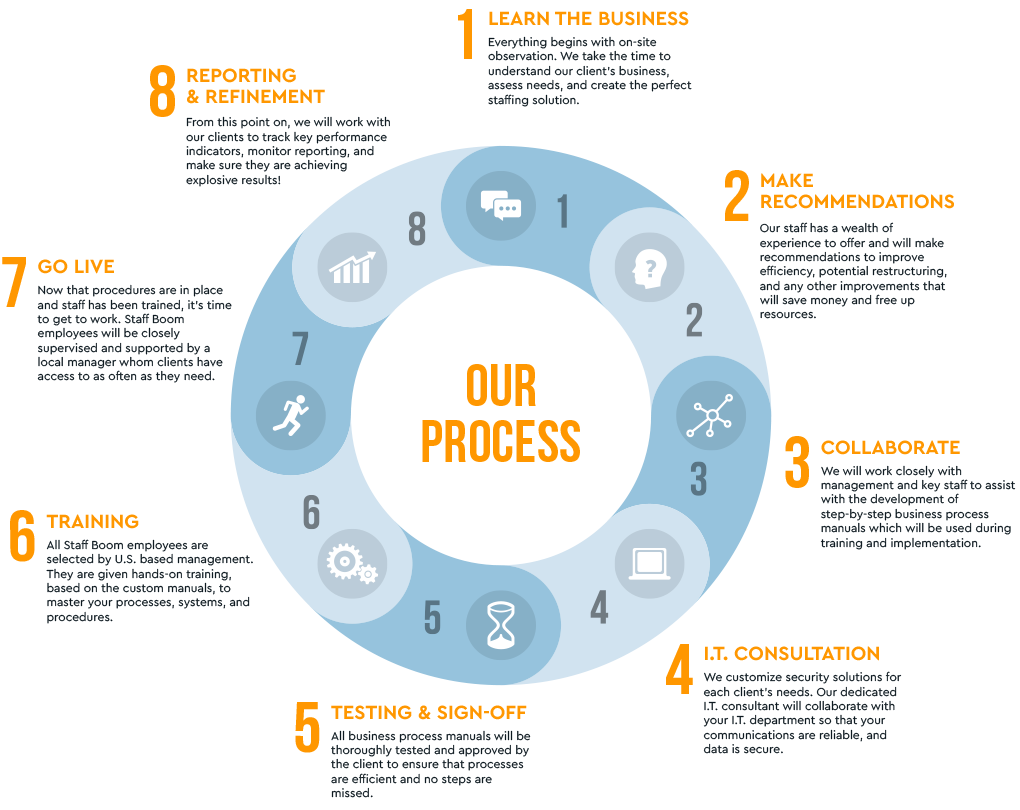

Our model is structured to minimize inefficiencies during the transfer of processes from your business to us. This model is well defined and allows flexibility to accommodate your unique business outsourcing requirements.

Everything begins with on-site observation. We take the time to understand our client’s business, assess needs, and create the perfect staffing solution.

Our staff has a wealth of experience to offer and will make recommendations to improve efficiency, potential restructuring, and any other improvements that will save money and free up resources.

We will work closely with management and key staff to assist with the development of step-by-step business process manuals which will be used during training and implementation.

We customize security solutions for each client’s needs. Our dedicated I.T. consultant will collaborate with your I.T. department so that your communications are reliable, and data is secure.

All business process manuals will be thoroughly tested and approved by the client to ensure that processes are efficient and no steps are missed.

All Staff Boom employees are selected by U.S. based management. They are given hands-on training, based on the custom manuals, to master your processes, systems, and procedures.

Now that procedures are in place and staff has been trained, it’s time to get to work. Staff Boom employees will be closely supervised and supported by a local manager whom clients have access to as often as they need.

From this point on, we will work with our clients to track key performance indicators, monitor reporting, and make sure they are achieving explosive results!

We leverage from best practices, combined with years of knowledge and experience to deliver ideal outsourcing solutions to support your business.

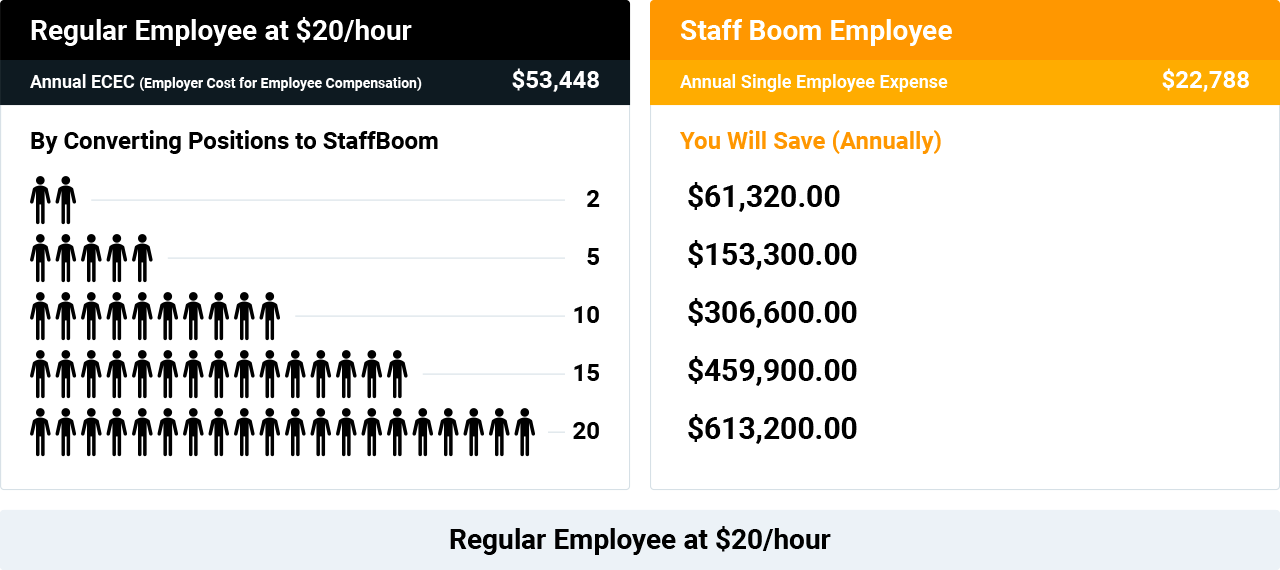

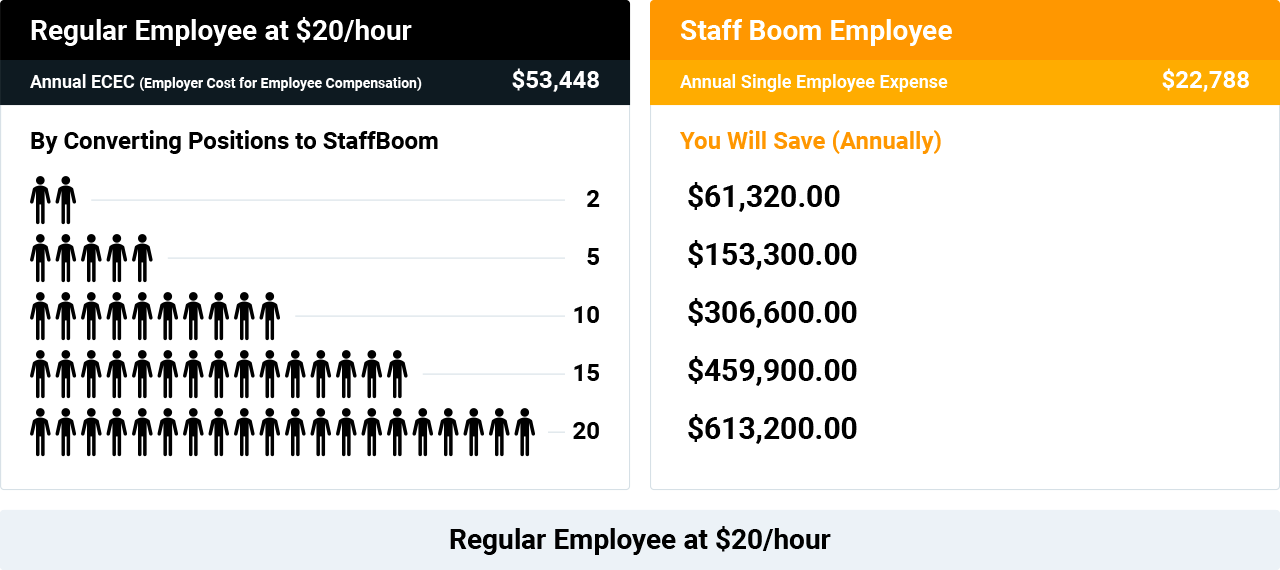

Here at Staff Boom we are so confident in our outsourcing model and pricing, that we provide full transparency when it comes to costs, as you can see below. Take a look at the pricing below and see how much you could be saving:

* pricing does not include one time onboarding expense. Onboarding expenses will vary based on the scope of work, materials, hardware and software needed for each clients unique solution.

To find out more, consult with our outsourcing specialists.