Globally, the insurance market’s growth has been slow, especially when compared to overall economic growth rates. In recent times, insurance premiums globally are expected to increase at a modest compound annual growth rate of 2.4% between 2024 and 2027. This growth is significantly slower than the economic expansion in some regions, like India, where the insurance sector might see an average growth of 7.1% during the same period due to factors like a growing middle class and innovation (Business Standard) (Deloitte United States).

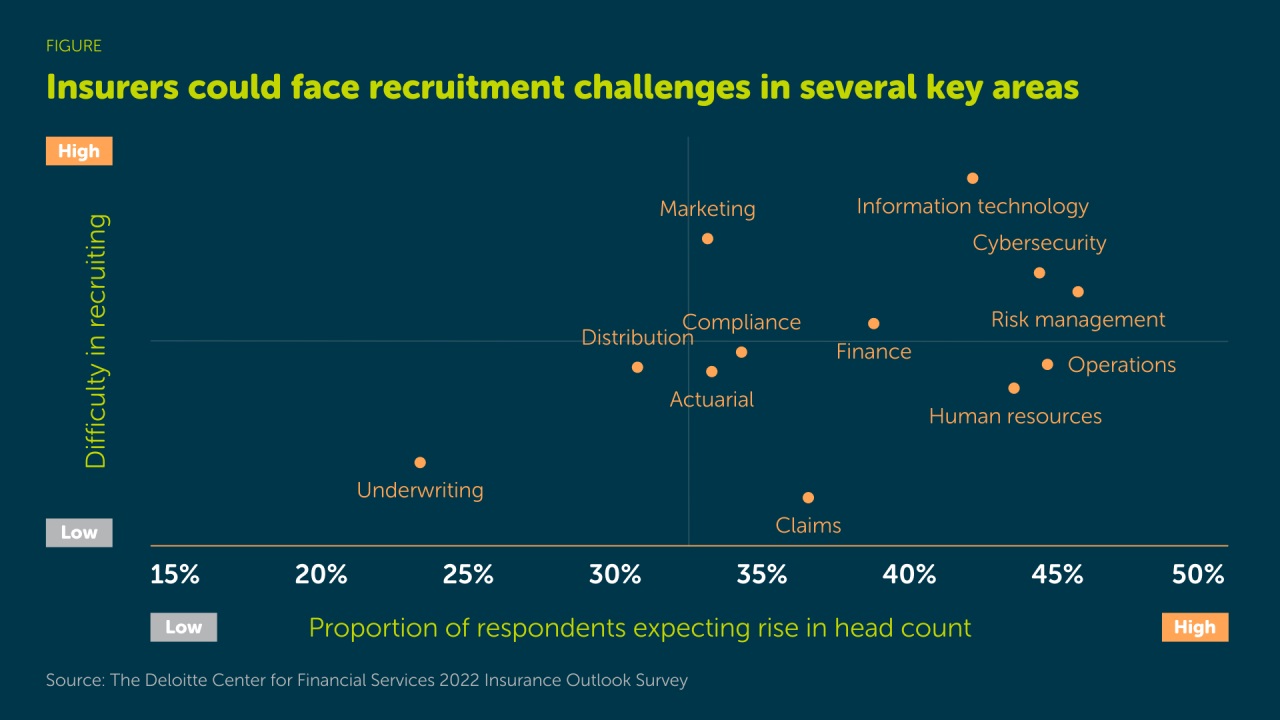

The unemployment rate in the U.S. insurance sector remains remarkably low at around 2.1%, which reflects a tight labor market where finding and keeping skilled workers is increasingly challenging (Deloitte United States).

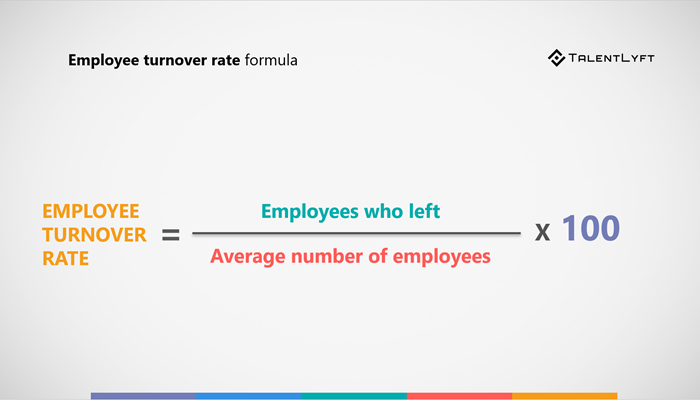

Historically, turnover rates in the insurance industry have increased from 8-9% to 12-15% recently, indicating that retaining employees is becoming more difficult (Deloitte United States).

This study, which is published twice a year, looks into how the insurance industry hires and keeps employees. The most recent report examined around 270,000 workers in the U.S. insurance carrier market, representing about 17% of the total market. Most of these employees (77%) work in property and casualty (P&C) insurance, with the rest in life and health (L&H) insurance companies (22%) and reinsurance companies (1%).

In the past 10 years, most insurance companies operated with roughly an 8-9% staff turnover rate, whereas now, it’s more typical for companies to operate in the 12-15% range, with voluntary turnover spiking at more significant levels. Currently, insurance carriers in the U.S. have around 1.56 million employees, which is 85,000 fewer than in 2020. This drop highlights a significant trend in how the insurance industry is hiring and keeping workers.

Studies such as The Jacobson Group and Aon-Ward’s semi-annual survey provide insight into hiring trends in the U.S. insurance sector, revealing a workforce of about 270,000 in the carrier market, which is around 17% of the total market.

The costs associated with turnover are substantial and include:

Employee turnover is a natural part of business, but there are hidden costs directly tied to turnover rate. We often think of turnover in terms of lost talent, but the financial implications run deep. Let’s unravel the hidden costs associated with turnover.

As soon as you receive a resignation letter you begin the search for another employee. This isn’t as simple as a single post on your company website anymore. Recruiting agencies, hiring services, and temp agencies command fees. Plus, there’s the cost of ads on social platforms like Facebook or LinkedIn. And don’t forget job boards like Indeed or Monster. These seemingly small expenses add up quickly.

Think about the time it takes to screen and interview candidates. For small to medium businesses, this often means key players are diverted from their core responsibilities. The question then arises: what important tasks are being left undone in the meantime?

On-boarding is no small task. Depending on the company and role, this process can span from a day to several weeks. It’s time that’s invested, but not directly productive.

Training isn’t just an investment of the new hire’s time, but also of those who train them. More often than not, managers and key personnel find themselves involved in the training process—explaining, answering, and rectifying. The “shadowing” process, while essential, does slow down production rates.

Every hour spent on training or filling a vacancy is an hour lost in productivity. It’s crucial to ask: can management even step into the shoes of the departing employee? In most scenarios, they can’t. Managers are swamped with their own duties. Hence, time slips away, opportunities vanish, and the cycle continues.

Turnover doesn’t just impact the bottom line; it affects the morale of existing employees. Watching colleagues leave, especially well-performing and well-liked ones, can be disheartening. This often leads to decreased engagement and productivity among the remaining staff.

New hires, despite their best efforts, have a learning curve. Mistakes are bound to happen. These inaccuracies not only disrupt the workflow but can be a potential liability. For businesses in professional services, errors might even open the doors to litigation.

Unemployment isn’t just about paying benefits. It also encompasses the time and money spent on potential legal proceedings. Moreover, as more ex-employees file for unemployment, your unemployment insurance rates could skyrocket.

A direct correlation exists between high turnover and increased worker’s compensation claims. A rise in these claims can adversely affect your experience rating, leading to higher premiums. This translates to more lost income and missed opportunities.

The tools used for training come with their own price tag. Whether it’s old-school printed materials or sophisticated online platforms, these costs are recurrent and often overlooked.

Phillips, Ebony, “Strategies to Reduce Employee Turnover in the Insurance Industry” (2023). Walden Dissertations and Doctoral Studies. 12185.

Market Report by McKinsey.

Director of Sales

Joe Overley is a Director of Sales at Staff Boom. Joe is an accomplished executive who possesses exceptional leadership skills and a proven track record in sales. He has a unique ability to establish strong relationships with people and inspires and motivates them to improve their relationships, sales, training, and knowledge. Joe’s unwavering commitment to success and his approach to staff training and development enabled him to achieve rapid advancement in the insurance industry. In his previous job, Joe was promoted to the district manager position within the first year of joining the company and subsequently became a regional sales manager, ultimately attaining the Vice President role within five years. Joe was responsible for several critical functions, including developing the sales process, sales training, and management development. He also oversaw the organic expansion of brick-and-mortar offices, the web sales environment, the agency call center, and quality control procedures for Northern California and Nevada.